Consumer durable loans are a common financing option for buying high-quality, long-lasting items like refrigerators, washing machines, and other household appliances. These loans are intended to help consumers purchase these things by spreading the expense over a period of time.

Why Opt For a Consumer Durable Loan

Here are some reasons why you might opt for a consumer durable loan:

- Simple financing: Consumer durable loans are an excellent way to finance large-ticket items that may not fit into your monthly budget. The loans are usually simple to apply for and have short approval times.

- No collateral: Consumer durable loans, unlike other forms of loans, normally do not demand collateral, which means you will not have to put up any assets as security for the loan.

- Flexible repayment options: Most consumer durable loans have flexible repayment options, which allow you to repay the loan over a time that works best for your financial position.

- Improves credit score: On-time loan repayment might improve your credit score, making it easier to get approved for future loans.

How to Apply For a Consumer Durable Loan

To secure a consumer durable loan on CASHe, here’s what you need to do:

- Download the CASHe mobile app from Google Playstore or iOS Appstore

- Create an account and select ‘Consumer Durable Loan’

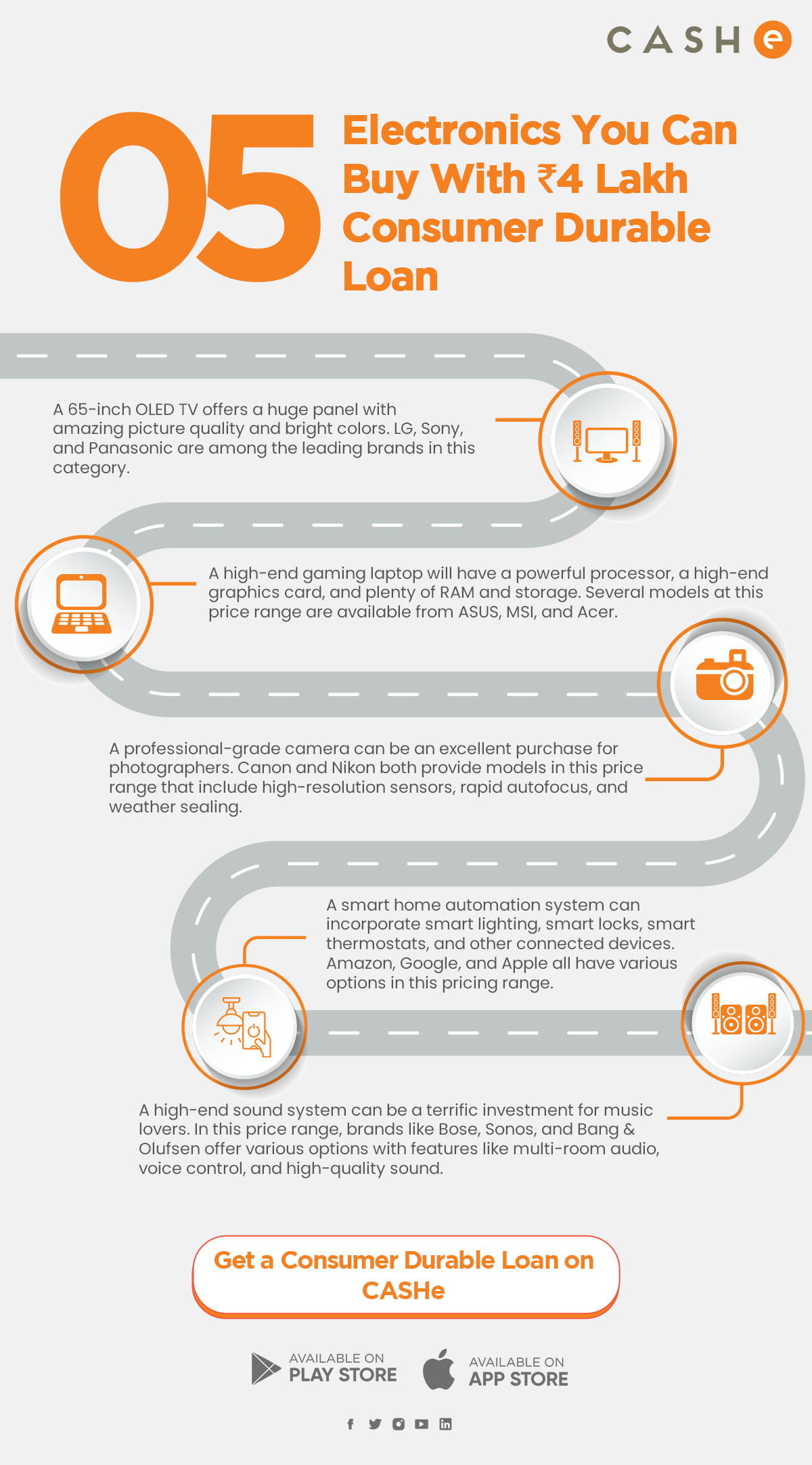

- Select the loan amount (from Rs. 15,000 t0 Rs. 4,00,000) and tenure (from 90 days to 540 days)

- Submit the required documents – income proof, address proof and identity proof

- Once the documents have been verified, the loan amount will be disbursed to your bank account

FAQs

Who is eligible for a consumer durable loan?

These are the eligibility criteria you need to keep in mind:

- You need to be an Indian citizen

- You need to be at least 18 years of age

- You need to be employed at an organisation or company

- You need to be making a monthly income of at least Rs. 15,000

- You need to be having all the required documents

What is the tenure for a consumer durable loan?

CASHe offers a tenure from 90 days to 540 days.

What is the processing fee for a consumer durable loan?

Processing of up to Rs. 500 will be charged.

What is the loan disbursal time for a consumer durable loan?

If you have submitted legible and legal documents and have a good credit score, the loan amount will be disbursed to your bank account within a few minutes.