When you think of a personal loan, you probably imagine a big chunk of money. But you may not know there are options outside of the traditional lender. The good news is digital lenders have exploded in the past few years. That means more options for finding the right one for your needs. Digital lenders offer different features than traditional banks do when lending to individuals. Think about it – most banks want to be as conservative as possible with their lending and don’t want to risk losing a lot of money if someone can’t repay their loan. They also don’t want to grant loans outside of what they can verify through a credit check or by using other methods. These limitations make it hard for people who need loans but don’t fit into the typical lending profile.

Who is a Digital Lender?

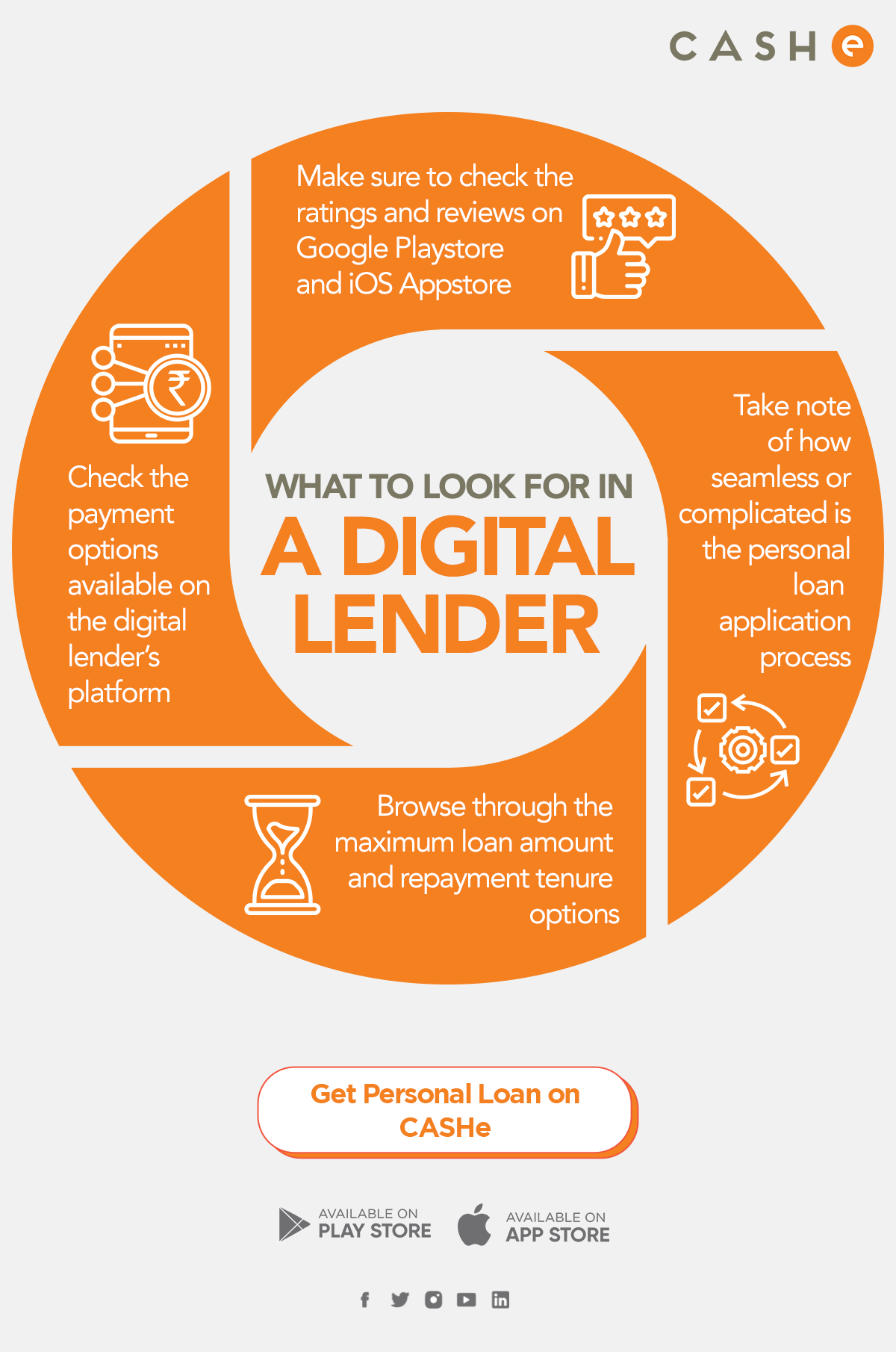

A digital lender is a type of financial service provider that offers personal loans, Pre-Approved CASHe Limit and buy now pay later deals to people in need. Digital lenders typically operate online and offer fast, efficient service. Unlike traditional lenders, digital lenders don’t require borrowers to go through a credit check. However, they do typically charge a fee for their services.

Advantages of Taking The Digital Route

- Can apply for a loan anytime, anywhere

- Easier and quicker process

- Requires minimal documentation

FAQs

What are the available repayment options?

You can repay the loan amount via NEFT, IMPS or bank transfer.

Do digital lenders take the same time as banks to lend money?

No, digital lenders are much quicke than traditional banks.

Can I repay in cash?

No, you cannot repay in cash.

What documents will I have to submit?

You have to submit income proof, address proof, identity proof and a photograph of yourself.