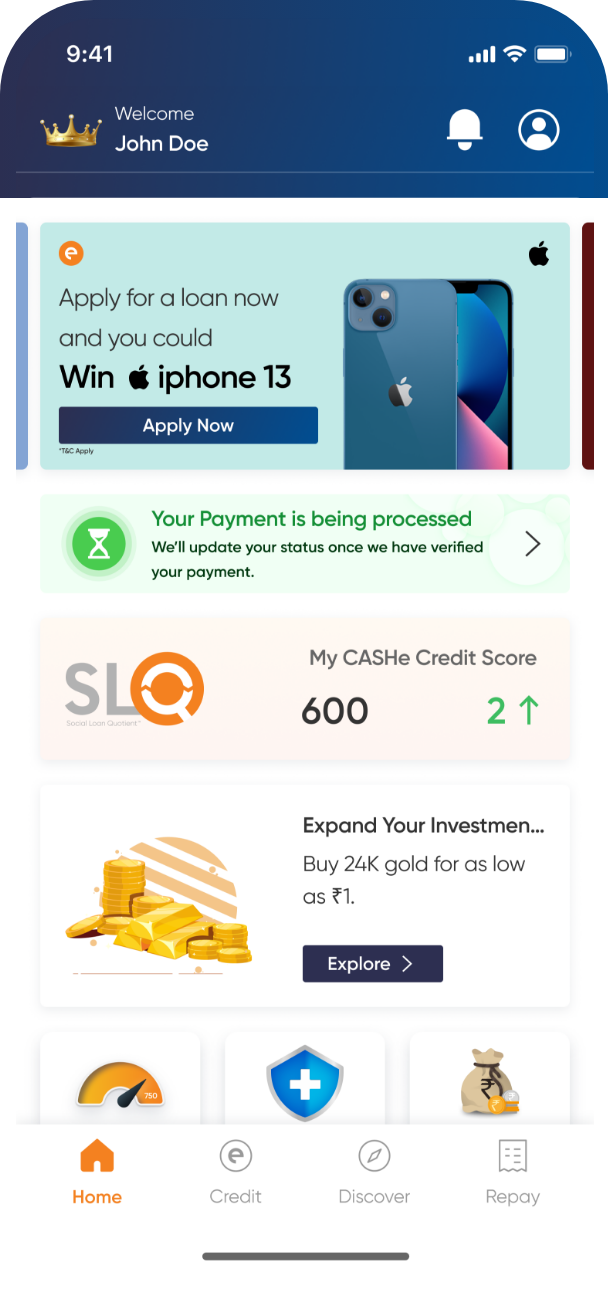

What is Credit on Gpay?

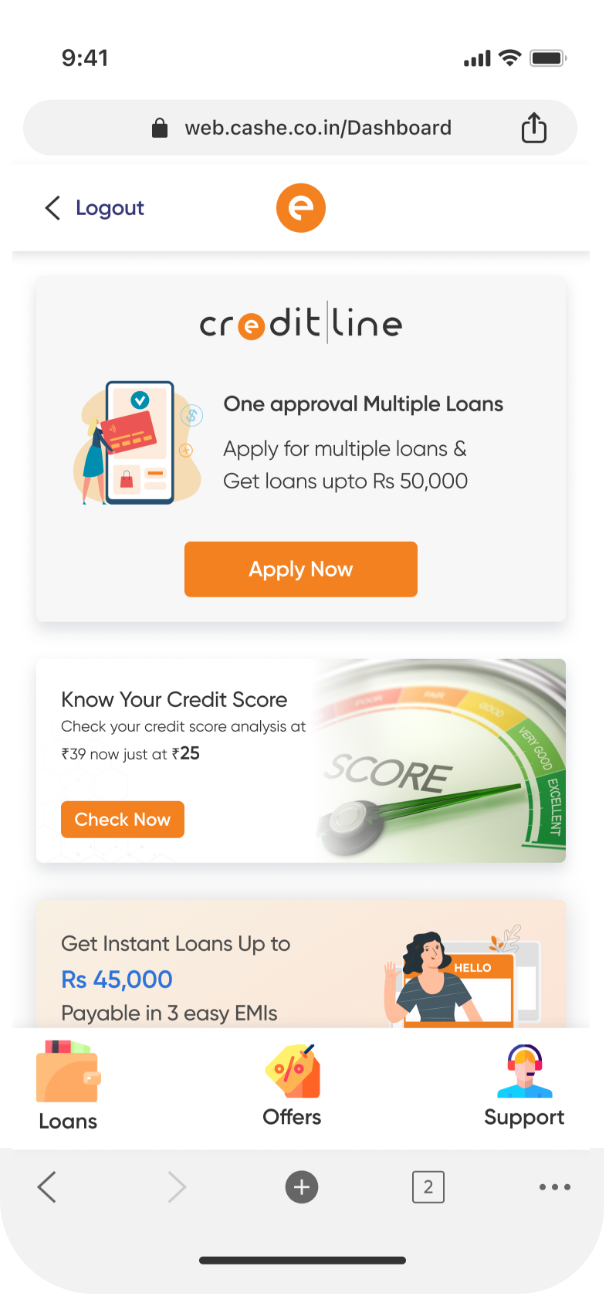

The Google Pay Credit service on CASHe allows you to take out a loan or credit online on the Google Pay application. It is perfect for those looking for short-term loans with an easy and convenient process. Just create an account and log into Google Pay to avail special Gpay loan offers. As the process is 100% digitised, you can apply for loans and credits from anywhere and anytime. You can choose the amount you need and repay it with interest incurred over a specific period of time. However, you should understand the terms and conditions before availing a Google Pay loan.

Features of Google Pay Loan

Online Application

You can apply for a loan digitally within the Google Pay app from anywhere without any physical paperwork.

Quick Approval

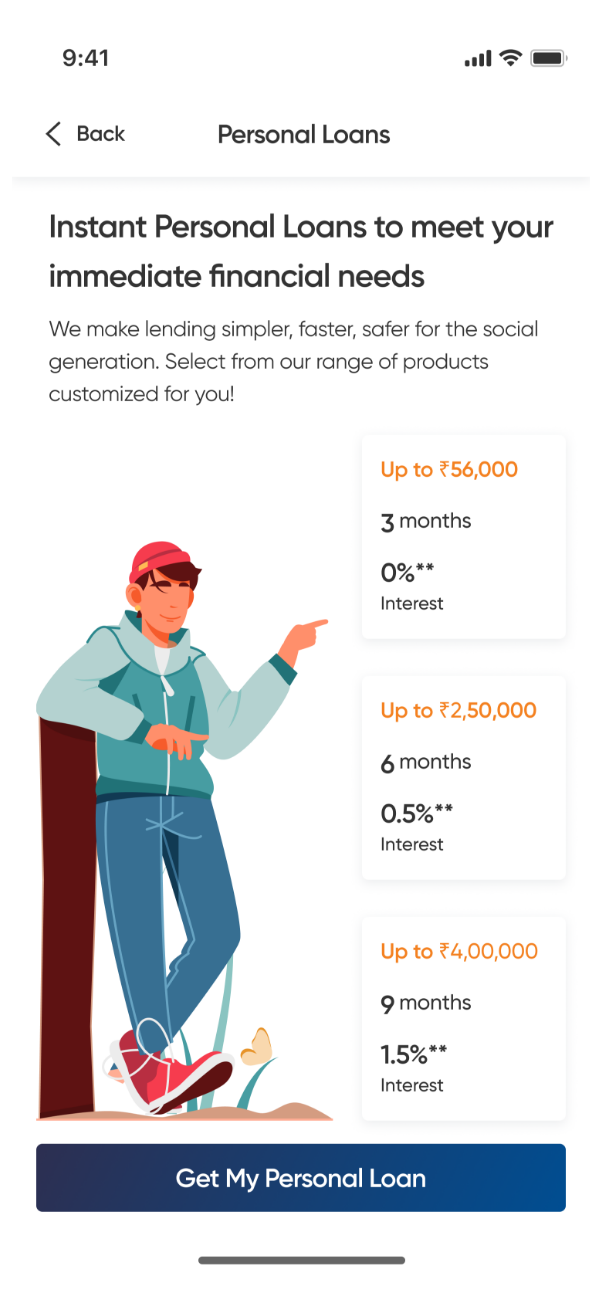

With CASHe’s Credit on GPay service, you can get quick approval for short-term loans of up to ₹2,00,000 with 3 EMIs and access the funds promptly unlike traditional loans, where you need to wait for days to get the funds.

Competitive Interest Rates

CASHe offers competitive interest rates to users for loans on Google Pay.

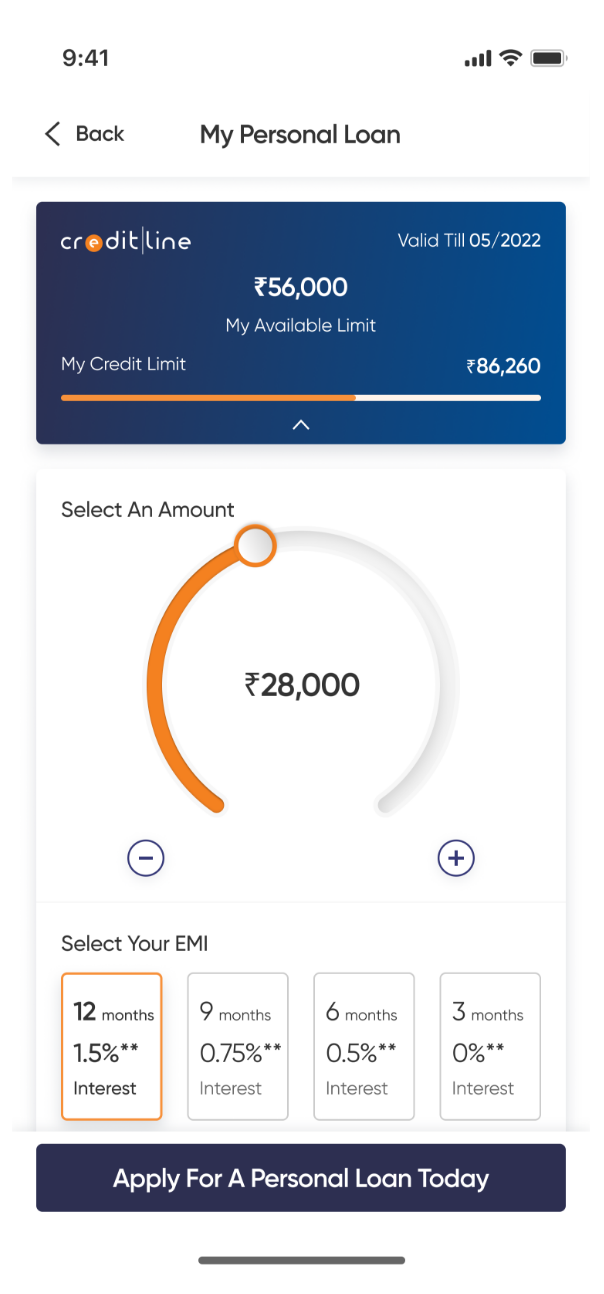

Flexible Loan Amount

You can choose a GPay loan amount of up to ₹2,00,000 based on your needs.

Flexible Repayment Options

Avail flexible repayment options of up to 3 EMIs so you can repay the loan conveniently.

Easy Tracking

Track your loan details including the loan amount, outstanding balance, interest paid, repayment schedule, and repayment status within the Google Pay app.

Benefits of Google Pay Credit

The major benefits of availing a GPay loan or Pre-Approved CASHe Limit on UPI are:

Convenience

You can apply for a CASHe Google Pay credit within the Google Pay app from the comfort of your home.

No Collateral Required

Google Pay credit is unsecured and hence, you do not need to provide collateral to avail these loans.

Security

Google Pay and CASHe offer the utmost security to protect your financial information and ensure secure transactions.

Notification and Reminders

Receive regular notifications and reminders for upcoming repayments so that you do not miss out on any repayments.

How to Get a Loan from Google Pay

Here is the step-by-step guide on how to get a CASHe loan on Google Pay:

-

Step 1: Check the eligibility criteria provided by Google Pay on the Google Pay app to see if you qualify for a loan.

-

Step 2: Click on the Apply for Credit or Loan or similar button.

-

Step 3: Provide required information including your income, employment, and other relevant data.

-

Step 4: Select the loan amount you need.

-

Step 5: Carefully read the terms and conditions including interest rates, repayment terms, and any associated fees.

-

Step 6: Once you have reviewed and agreed to the terms, submit your loan application through the app.

-

Step 7: Google Pay will process your application, and you will receive a notification regarding the approval status.

-

Step 8: Accept the loan offer.

-

Step 9: Once you accept the loan offer, the funds will be credited to your Google Pay account.

-

Step 10: Set up the repayment method as per the agreed terms.

Eligibility for CASHe GPay Pre-Approved CASHe Limit/Loan

To avail a CASHe GPay Pre-Approved CASHe Limit or loan, you must be:

- 18 Years of age or older

- Must be an Indian resident

- Have an active bank account

- Must have a good repayment history

Documents Required for CASHe GPay Pre-Approved CASHe Limit/Loan

The major documents required for a CASHe GPay Pre-Approved CASHe Limit or loan include:

- Aadhar Card

- PAN Card

- Address Proof

- Income Proof

- Passport-size Photographs

Get Credit on GPay from CASHe

Wait no further and unlock GPay’s financial playground with CASHe. Fulfil your cash and credit requirements and make your dreams come true. With Google Pay and CASHe, say goodbye to financial worries and commence a great journey.

Your dreams, your terms – it’s all with CASHe and GPay!