Reasons for Securing a Two-wheeler Loan

There are multiple reasons why you should secure a bike loan online. Some of them are:

You are one step closer to having a convenient mode of transportation. Having your own bike makes it much more convenient to travel from one place to another without having to rely on anyone else or another form of transportation.

It helps to build a credit profile. By applying and securing a loan, you are paving a path for yourself to start building a credit profile. You will start improving your credit score as long as you keep paying the EMIs on time.

You learn about financial discipline. When you know you have a fixed amount of money being debited from your bank account, you will make sure to be careful about your finances and not indulge in unnecessary expenses.

Things Covered Under Two-Wheeler Loan

A two-wheeler loan from CASHe can cover all the major expenses related to the purchase of a bike or scooter. This includes the cost of the two-wheeler, registration charges, etc.

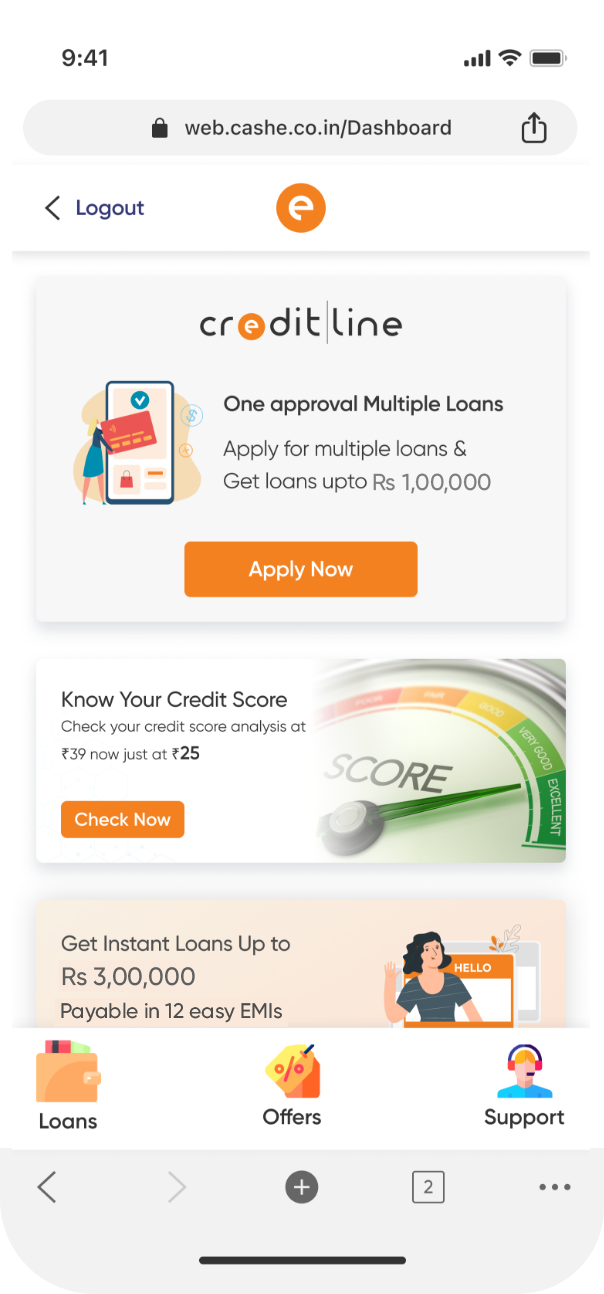

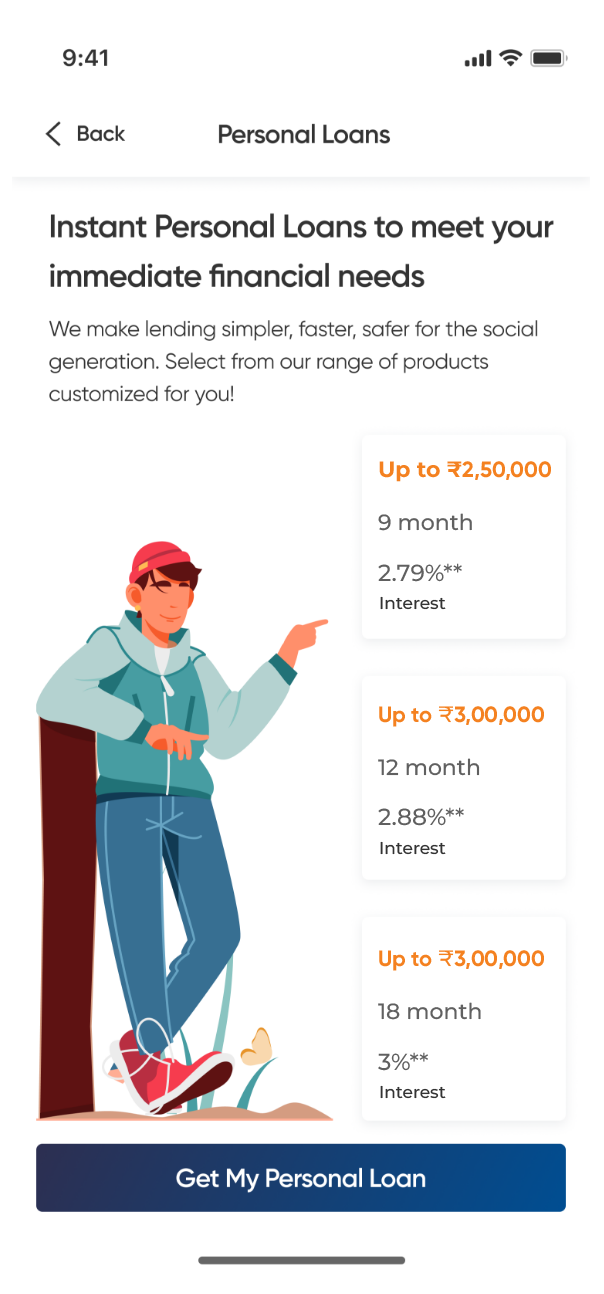

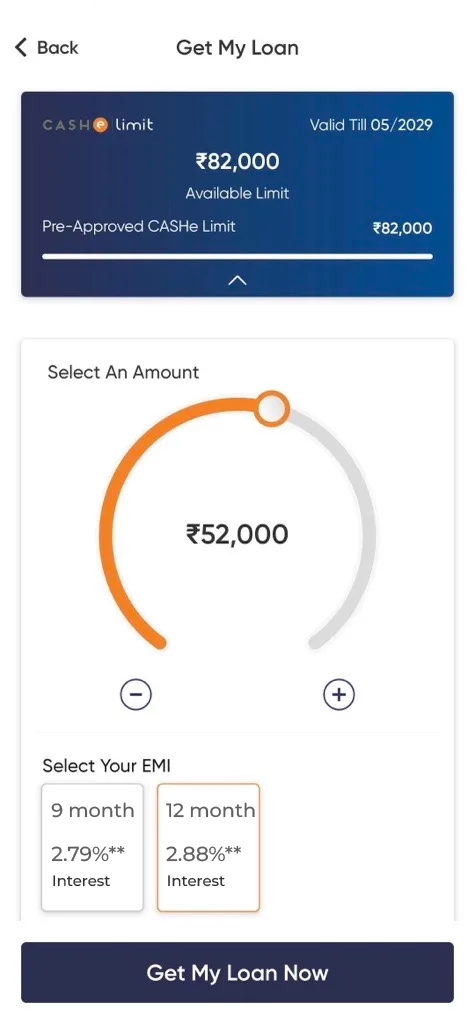

CASHe Interest Rate & Charges

The two-wheeler loan interest rate at CASHe is calculated on a per-month basis for the bike loan amount. The two-wheeler loan interest rate ranges from 2.79% up to 3% (reducing balance interest) per month on the entire bike loan amount. You will also get a 5-day interest-free grace period to pay your two-wheeler loan EMI at the end of every month. Any subsequent delay in EMI payment will result in 0.1% interest fee penalty per day.

Additionally, at CASHe, we also levy a plain processing fee of 2.5% of the loan based on the two-wheeler loan product you are eligible for.

Tax Benefits of a Two-Wheeler Loan

As per the Income Tax Act, salaried individuals cannot claim tax exemptions on two-wheeler loans. However, if you are a business owner or a self-employed individual, you can apply for tax exemptions by claiming the two-wheeler loan as a business expense.