Today, securing a loan has become so easy that it only takes a few minutes to apply for one. Personal loan apps have made it possible to reduce the time, effort, and energy that one invests in securing a loan. Since these are mobile apps where everything is digitized, there is no need to personally visit a bank.

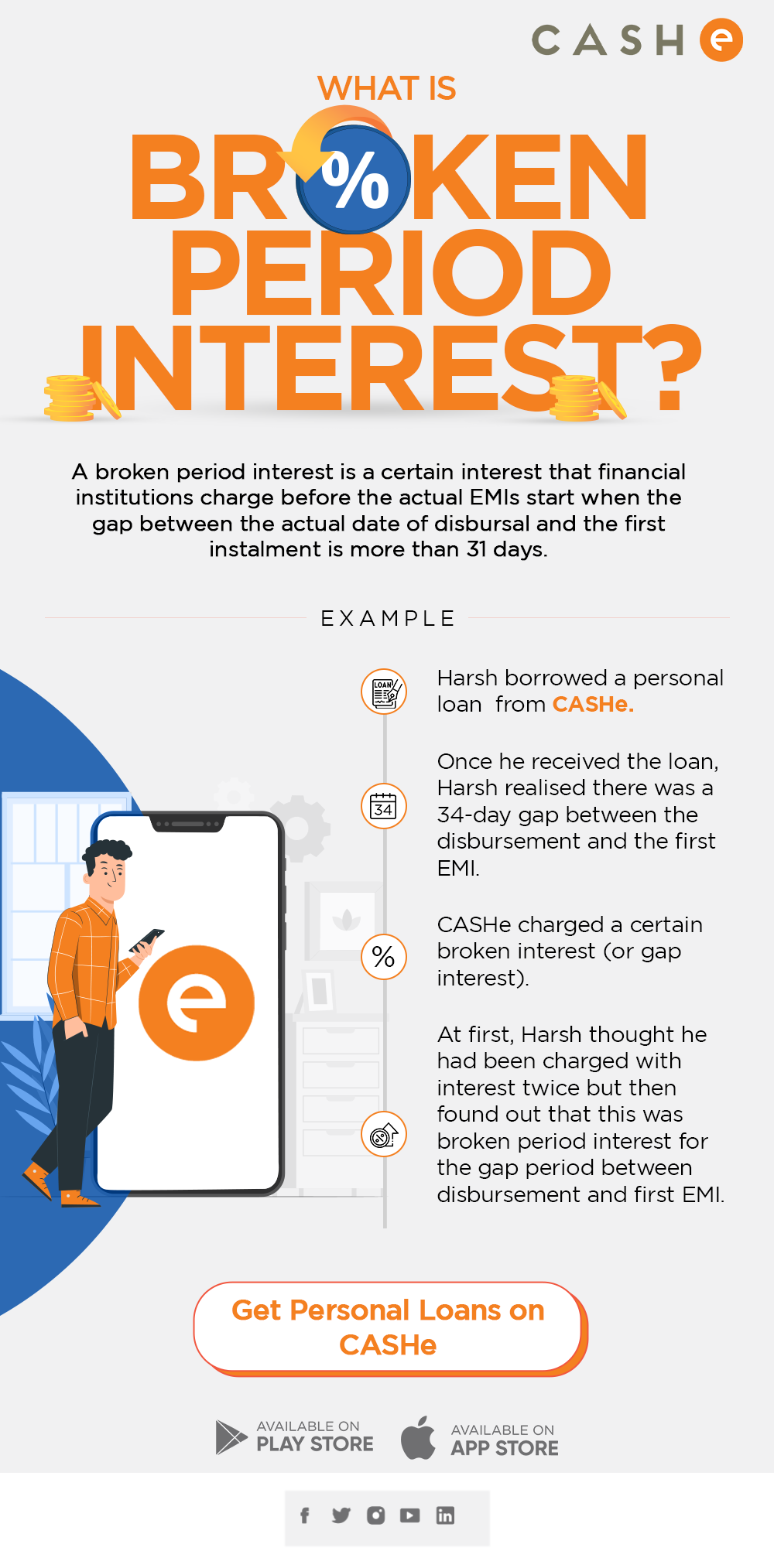

But while applying for a personal loan, it is vital that you understand basic terminologies and the role each one plays in the process from application to approval. This makes it easier to understand every step of the process. One such term that is overlooked but is equally important is Broken Period Interest.

FAQs

Is broken period interest a second interest charged on the personal loan?

No, broken period interest is not a second interest and does not occur with every installment.

How do you calculate broken period interest?

Broken period interest is calculated on the time period between your loan disbursement and the first EMI date.

Is broken period interest calculated on all types of loans?

Yes, it is calculated on all types of loans.

Is broken period interest the same as GAP interest?

Yes, broken period interest and GAP interest are the same.