Loan applications have grown in popularity in recent years as a handy and easy way to borrow money. While lending apps might provide instant access to finances, they are fraught with falsehoods and blunders. Many people feel that loan apps are a one-size-fits-all answer to their financial issues, or that they are the only choice for those with poor credit. Yet, it is critical to recognize the risks and disadvantages of using loan apps, as well as the prevalent myths and errors related with their use. In this article, we will debunk some of the most prevalent loan app myths and blunders, as well as provide suggestions and advise on how to utilize them properly.

Common Mistakes You Can Avoid

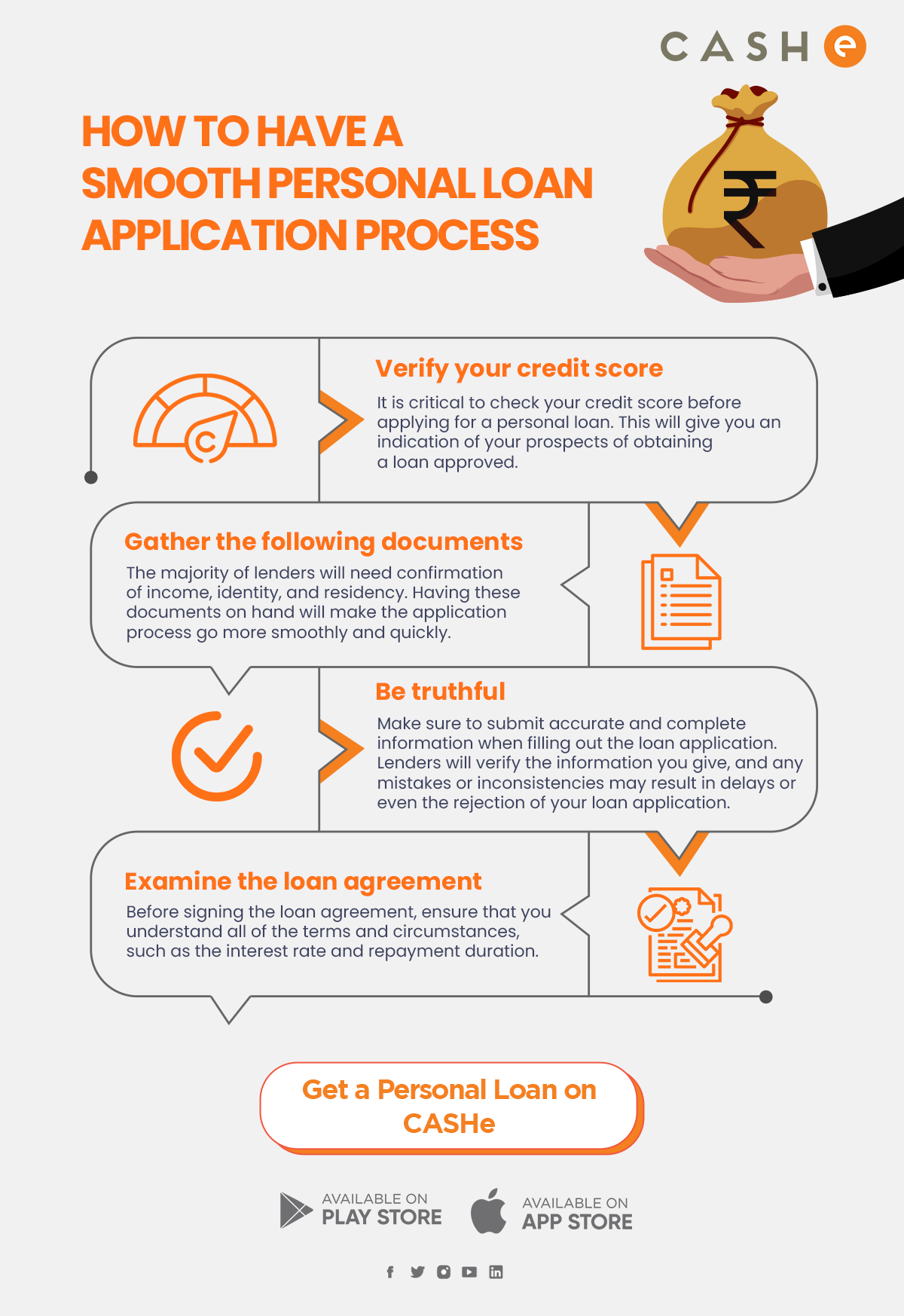

Asking for a personal loan can be a simple way to get money for a variety of reasons. Yet, there are certain frequent mistakes that people make that might cost them more money or cause their loan application to be rejected. These are some common errors to avoid when applying for a personal loan:

- Failure to verify your credit score: When lenders assess your loan application, they take into account your credit score. Check your credit score before applying for a personal loan to ensure it is in good standing. If you have a low credit score, work on raising it before applying for a loan.

- Applying for too many loans at the same time: Your credit report is updated every time you apply for a loan. Applying for too many loans at once will damage your credit score and make it more difficult to get a loan accepted. Just apply for loans that you are serious about and believe you will be approved for.

- Failure to shop around for the best interest rates: Various lenders provide varying interest rates, and the interest rate you receive can have a substantial impact on the entire cost of your loan. To discover the best price, shop around and compare interest rates from other lenders.

- Failure to read the fine print: Be sure you read the fine print and understand all of the terms and conditions before signing any loan arrangement. Check that you understand the interest rate, repayment period, fees, and any penalties for early or late payments.

- Borrowing more than you need: Borrowing more than you need can be tempting, but keep in mind that you’ll have to pay interest on the entire amount. Borrow only what you require and can afford to repay.

- Ignoring penalties and fees: Fees and penalties for personal loans are common, including application fees, late payment fees, and prepayment penalties. When signing the agreement, be sure you understand all of the costs and penalties related to your loan.

By avoiding these blunders, you can improve your chances of being approved for a personal loan with favorable terms and saving money.

Common Myths That Are Not True

- Personal loans are only available to those with good credit: This is not totally correct. While having good credit increases your chances of getting approved for a personal loan, many lenders offer personal loans to persons with less-than-perfect credit. But, you may be required to pay a higher interest rate and provide collateral to secure the loan.

- Personal loans are only available in times of emergency: While personal loans are useful for unforeseen needs or crises, they can also be used for debt reduction, home repairs, or even to support a trip. Personal loans can be used to cover any financial necessity, as long as you can return the loan.

- Personal loans are usually expensive: Personal loan interest rates can vary greatly based on your credit score, income, and the lender you choose. Personal loans, on the other hand, might be cheaper than other forms of credit, such as credit cards, which can have higher interest rates and fees.

- Applying for a personal loan will lower your credit score: Applying for a personal loan usually results in a hard inquiry on your credit report, which might temporarily lower your credit score. But, the effect is usually minor, and if you make your payments on time, a personal loan might actually help you improve your credit score over time.

FAQs

Are there any tax benefits on a personal loan?

No, there are no tax advantages to taking out a personal loan. This is due to the fact that personal loans are rarely used to fund investments or other tax-deductible expenses. But, if you take a personal loan to finance a business, the interest may be deductible from your taxes.

What happens if I can’t repay my personal loan?

If you are unable to repay your personal loan, you may incur late fees and penalties, and your credit score may suffer as a result.

How long does it take to get a personal loan?

The time it takes to get a personal loan can vary depending on the lender and your individual situation. Generally, it takes just a few minutes.

Can I prepay a personal loan?

If you are unable to repay your personal loan, you may incur late fees and penalties, and your credit score may suffer as a result. Furthermore, the lender may pursue legal action to recover the debt, which may involve wage garnishment, asset seizure, or even a lawsuit. If you’re having trouble paying payments, you should contact your lender to see if any choices are available.