Planning a wedding can be an expensive and overwhelming process, especially if you don’t have much money or resources. Even the most well-off couples often find themselves asking, “What if we had more money for this?” Luckily, there’s a solution: a wedding loan.

What is a Wedding Loan?

A wedding loan may sound like something your friend offers to help you out with some cash. However, it is not just any loan – it is a high-interest lending agreement that provides financial support for your wedding.

Dealing With Wedding Expenses

The cost of a wedding, especially an Indian wedding, is tremendous. Brides and grooms are constantly on the lookout for ways to cut corners without sacrificing quality. One way to save money is to stay on top of your expenses from the start. Look into costs like caterer fees, decor fees and other miscellaneous fees that can add up quickly. Also keep an eye out for surprises like venue fees, which may not show up on the initial estimate. Finally, don’t forget to factor in any additional costs you might incur during the planning period. These can include things like gifts or flowers that you need to buy after the big day has come and gone.

FAQs

Is a wedding loan a secured loan?

A wedding loan is a personal loan borrowed for the purpose of using it for wedding purposes. A personal loan is an unsecured loan.

What if I don’t use some of the loan amount?

That’s completely fine! In fact, you can utilise the money to repay the loan.

Can I repay the loan over months?

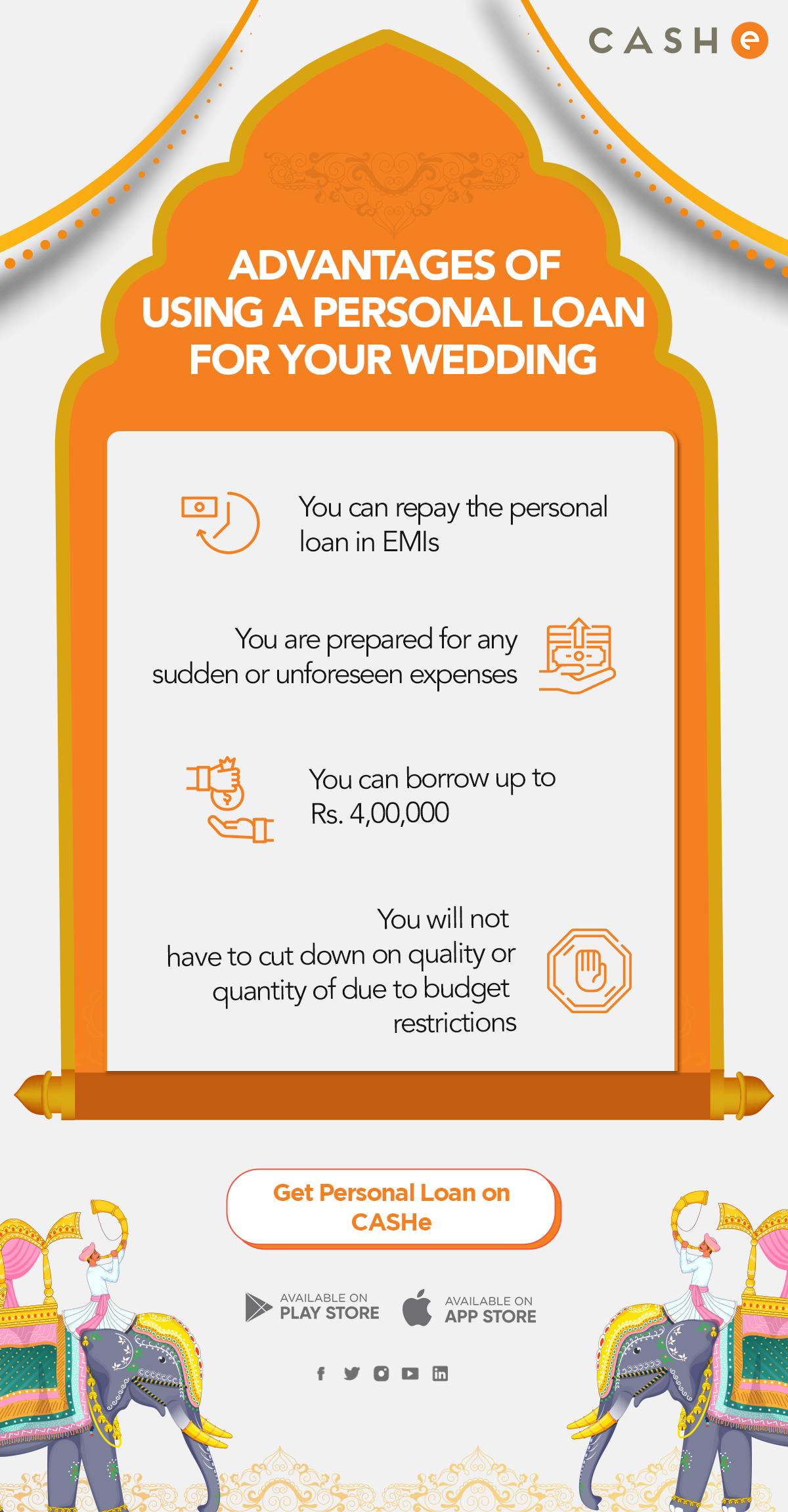

Yes, you can repay the loan amount in equated monthly installments (EMIs).

What wedding expenses does the wedding loan cover?

From the wedding outfits to the wedding decor, wedding venue to wedding catering, the wedding loan can cover all kinds of wedding expenses.