It has become so easy for people to gain access to funds through numerous financial tools. Whether for an emergency or end-of-month shopping for household essentials, these expenses can be taken care of by applying for a personal loan or an instant Pre-Approved CASHe Limit from a relevant mobile app.

FAQs

How does a line of credit work?

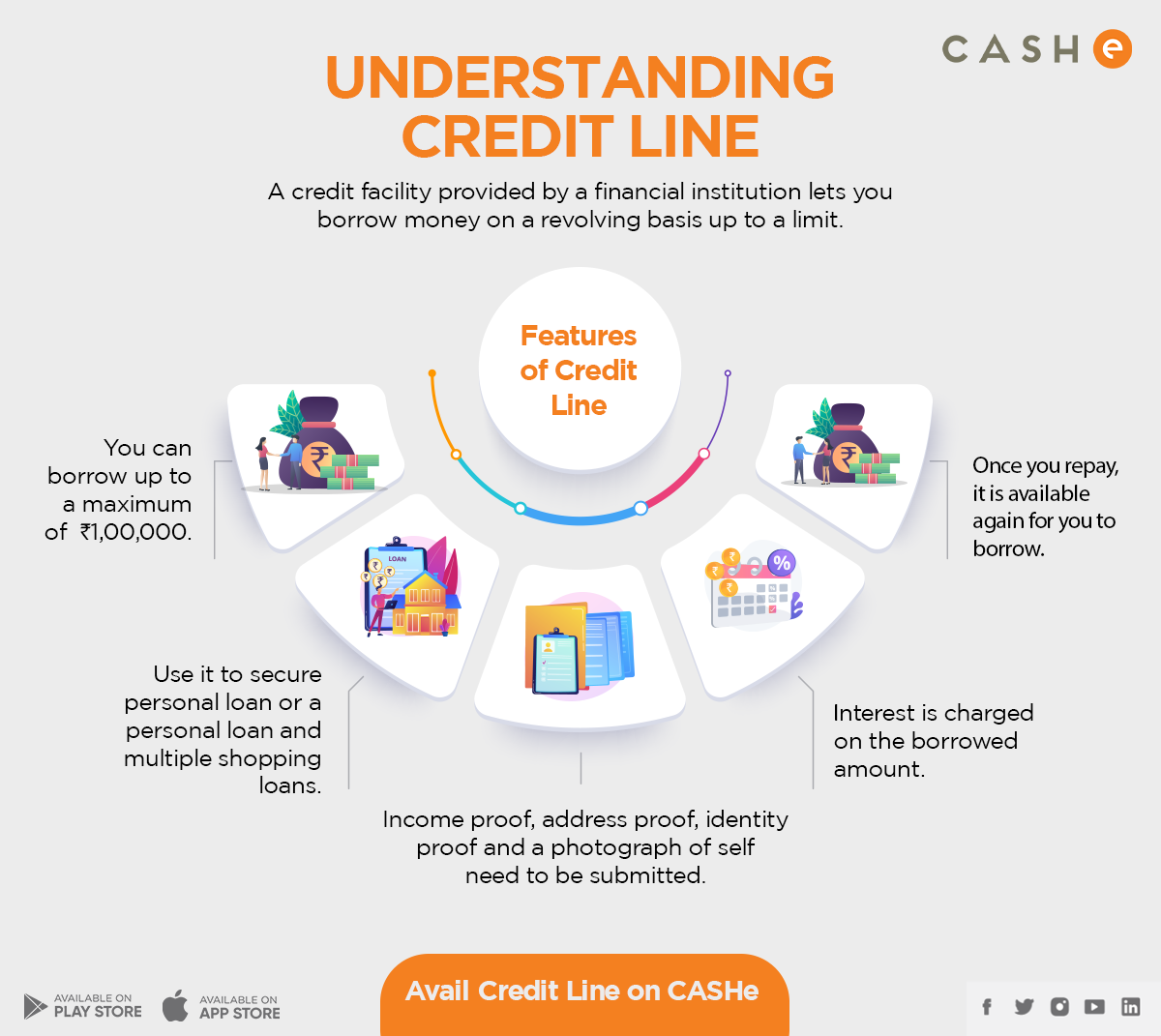

When you apply for a line of credit, it gives you access to funds on demand, up to a pre-set limit. You are charged interest only on the borrowed amount. Once you make the repayment, it is available again for borrowing.

Is having a line of credit a good thing?

Yes, it can be a good thing. But it would be best if you were smart about how much you borrow so that it is easy for you to repay it.

What is the maximum amount you can borrow from the Pre-Approved CASHe Limit?

On the CASHe app, you can secure a maximum amount of Rs. 1,00,000 for the personal Pre-Approved CASHe Limit.

Is a line of credit better than a credit card?

A line of credit is easier and more convenient than a credit card.

Can I get a line of credit with poor credit?

Yes, it can be difficult securing a Pre-Approved CASHe Limit with a poor credit score, and in some cases, your application can be rejected as well.