If you have a bank account, then you must have used a cheque at some point in time. This cheque is a piece of paper that you can use to send money from your bank account to another. But did you know that not all cheques can be cashed at the bank counter? One such cheque is a crossed cheque.

A crossed cheque is safer than a regular cheque as only the person whose name is on it can get the money, and it must be deposited into a bank. This makes it a safe and secure way to transfer money.

With the following read, let’s understand everything about cross cheques, including how to write a cross cheque, types of cross cheques, why they are important, and more.

What is a Cross Cheque?

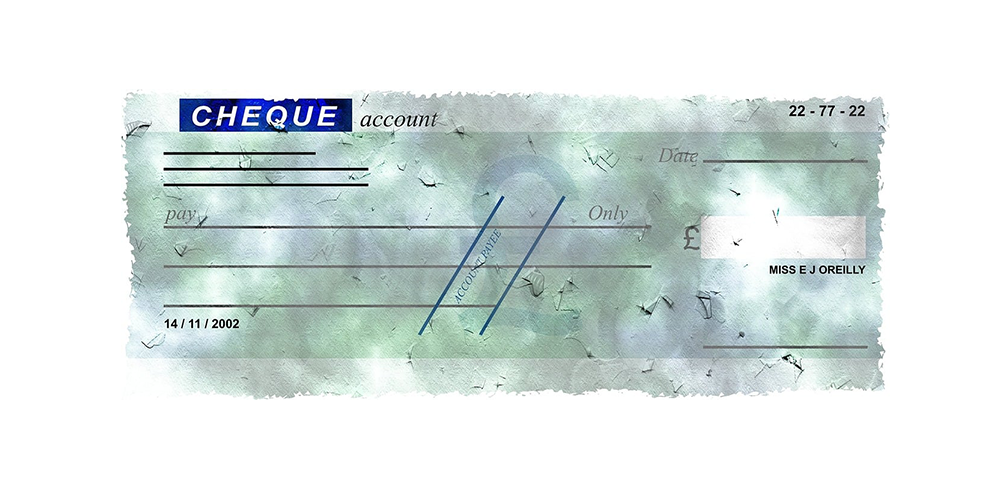

Officially termed as a crossed cheque, it is a cheque with two parallel lines drawn on the top left corner or across the whole cheque. This small marking changes how the cheque works. Instead of allowing someone to cash it at the counter, a crossed cheque must be deposited into a bank account, as mentioned earlier. This makes it safer, as even if someone finds the cheque or steals it, they cannot use it. Only the person whose name is written on the cheque can receive the money in their bank account.

Purpose and Importance of Cross Cheques

Now, comes the question – why do people use cross cheques instead of normal cheques? Here, we list the major reasons why cross-checks are preferred:

- It allows safer transactions as the money can only be deposited into a bank account.

- It helps in sending money to the right person, as only the person whose name is written on the cheque can get the money.

- Many businesses use cross cheques for security and proper record-keeping.

Types of Crossings on a Cheque

There are different types of cross cheques and each of them defines a different level of security.

General Crossing – This is the cross cheque where just two parallel lines are drawn. The cheque can be deposited into any bank account.

Special Crossing – Here, the name of a specific bank is written inside the lines. This means the cheque can only be deposited in that bank.

Account Payee Crossing – In this type, the words “Account Payee” are written inside the lines. Only the person whose name is on the cheque can deposit it.

Not Negotiable Crossing – This cheque, with “Not Negotiable” written on it, can be transferred to another person, but it cannot be used for immediate cash withdrawal.

Make sure you know these types of cross cheques so that you can use them correctly.

How to Cross a Cheque?

Crossing a cheque is as simple as writing down something on paper. Here are the steps involved:

Step 1: Take a blank cheque

Step 2: Draw two parallel lines across the cheque or the top left corner.

Step 3: Write the crossing type, like “Account Payee” or a specific bank name, inside the lines.

Step 4: Fill in the cheque details such as the recipient’s name, the amount and your signature.

Legal Implications and Regulations

There are some rules about cross cheques that you should be aware of-

- Once a cheque is crossed, it cannot be changed back to an open cheque.

- If it says “Account Payee”, only the person named on the cheque can deposit it.

- Banks check crossed cheques carefully to prevent fraud.

- If a crossed cheque is lost, banks may ask for extra verification before processing it.

Also Read : How to Write Cancelled Cheque

Conclusion

So, a crossed cheque is certainly a safe way to send money. If you ever want to make a payment but do not want the risk of the cheque being misused, make sure you know how to cross the cheque.

What if you need urgent funds but do not want to wait for a cheque to clear? That’s where CASHe Instant Personal Loans can help!

CASHe offers instant loans of up to ₹3 lakhs with competitive interest rates. Whether you need money for emergencies, shopping, or travel, you can apply for a loan through the CASHe app and get approval within minutes!