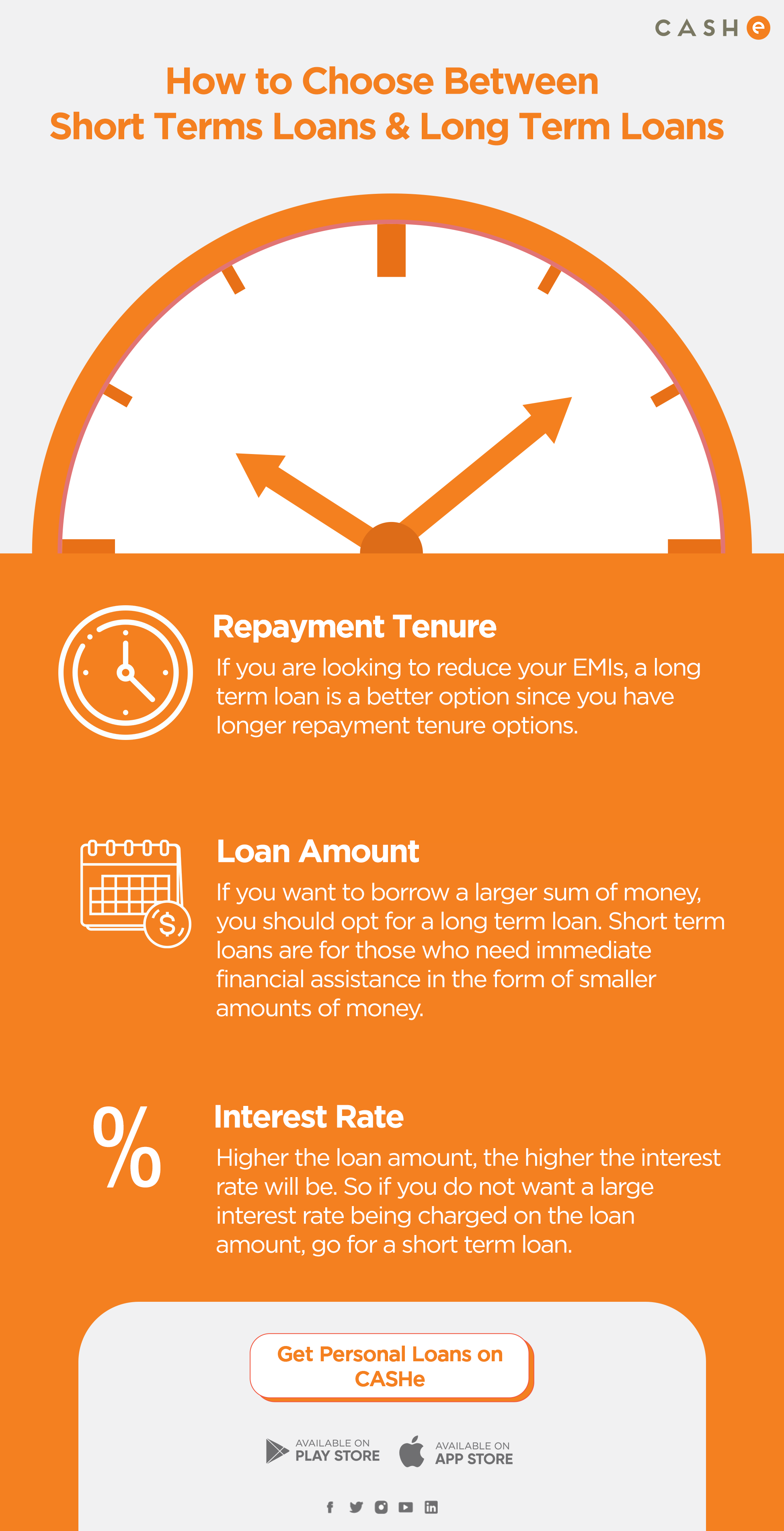

Today, borrowing loans have become so much more convenient and easier. All you have to do is download a personal loan app on your smartphone, create an account and apply for a loan. What’s more, different kinds of loans are available so you can choose the one that suits you. You can also choose between short-term loans and long-term loans.

Advantages of Short Term Loans

Some advantages of short-term loans are:

- Easier and quicker to acquire the loan amount

- Suitable choice for financing immediate, small amount expenses

- Lower interest rates

Advantages of Long-Term Loans

Some advantages of long-term loans are:

- Longer repayment periods

- A better option for building credit

- Smaller EMI amounts

FAQs

Do lenders prefer short or long-term loans?

While there is a higher interest rate charged on long-term loans, lenders prefer short-term loans since the money is repaid much more quickly.

Does a short-term loan affect your credit?

Yes, it does since your credit score will be checked while reviewing your application. But this will be temporary and you can improve your credit score by repaying the loan amount on time.

What is the purpose of a long-term loan?

A long-term loan lets you borrow a more significant amount and with a longer repayment period. You end up paying EMIs in smaller amounts, making it easier for you to manage your finances.

What’s the longest term loan you can get on CASHe?

You can borrow a maximum of Rs. 4,00,000 with a tenure of 1.5 years.